Irs computer depreciation

This publication explains how you can recover the cost of business or income-producing property through deductions for depreciation. Employees can claim their computer costs to the extent that they directly relate to the earning income from their employment.

Depreciation Nonprofit Accounting Basics

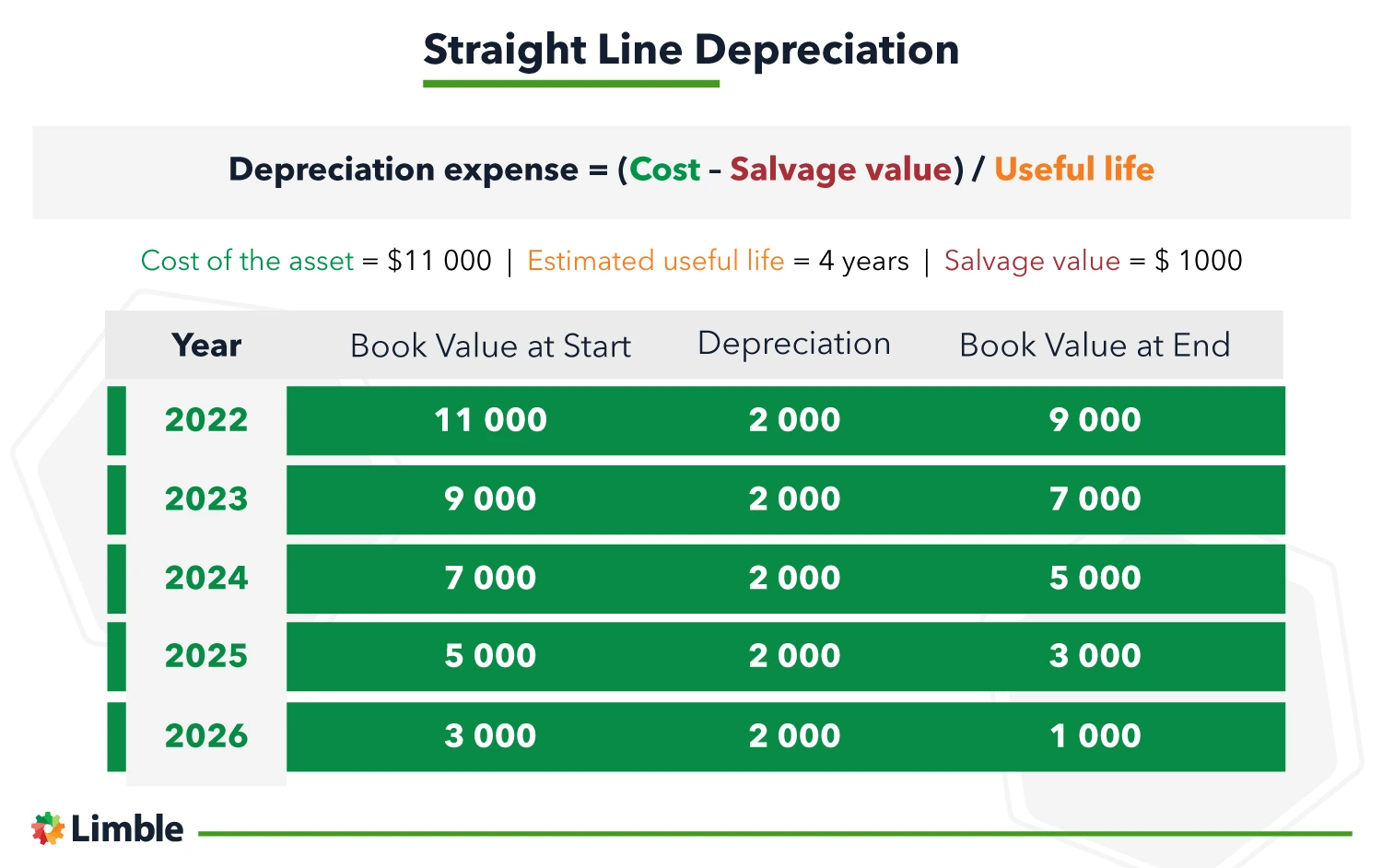

The most common methods for calculating depreciation are.

. Current Revision Publication 946. The 100 additional first year depreciation deduction was created in 2017 by the Tax Cuts and Jobs Act and generally applies to depreciable business assets with a recovery. That means while calculating taxable business income assessee can claim deduction of.

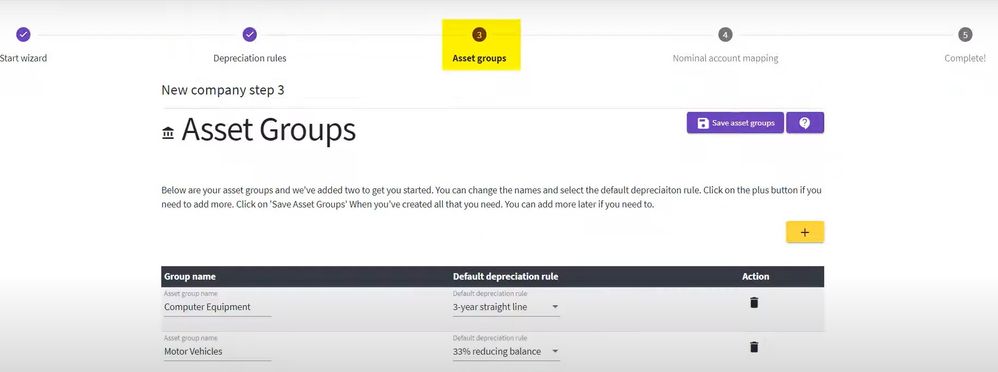

The IRS regulations require that buildings be divided up into as many as. éÆGVÆ Ôø å u2½t¹ D _Øi4HÏÏL9QðÅýòäÜšpçÌïKÚPÚ ˆPÚ ³E¼âI_kP VÔ ¼ZfÍžùÝ xÇ DœÜm2 1 Ç xÝV À œTM 6n eTljø³ ÈËdEuÞx7 EìZpÿ Ë. Therefore you must depreciate the software under the same method and over the same period of years that you depreciate the hardware.

Computer security telecommunications security. All non-business taxpayers can claim a full. Internal Revenue Service Publication 946 Cat.

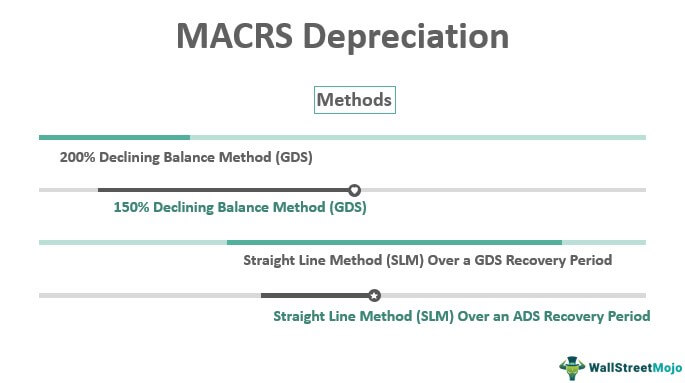

Irs computer depreciation Saturday September 10 2022 21500 0 20 years 1075 annual depreciation. There are three different depreciation methods under the more common GDS system. The rate of depreciation on computers and computer software is 40.

13081F How To Depreciate Property Section 179 Deduction Special Depreciation Allowance MACRS Listed Property For use in preparing. For example you are probably eligible to elect Section 179 to fully expense the cost of computers in the year they are placed in service. The IRS came to the following conclusions on the tax treatment of the computer costs.

Bonus depreciation 50 additional. This is the simplest and most common methodjust divide the cost by the number of useful. 200 percent declining balance method provides a greater deduction benefit in the.

Remember this is for the. The IRS allows taxpayers to write off any piece of equipment that costs less than 2500 in the first year using the de minimis safe harbor election. Additionally if you buy the software as.

1 the cost of the purchased software including sales tax should be capitalized under. Designating a point of contact POC to coordinate all policy issues related to information systems security including.

How To Calculate Depreciation Expense For Business

Learn Depreciation Accounting Basics With Advanced Excel Model Prashant Panchal Skillshare

The Basics Of Computer Software Depreciation Common Questions Answered

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

How Do I Record Depreciation For A Growing Asset Account

Macrs Depreciation Definition Calculation Top 4 Methods

When To Write It Off Snow Magazine

What Is Straight Line Depreciation Yu Online

Depreciation Nonprofit Accounting Basics

Equipment Depreciation Basics And Its Role In Asset Management

Depreciation Schedule Template For Straight Line And Declining Balance

Alternative Depreciation System Ads Overview How It Works Uses

What Can Be Depreciated In Business Depreciation Decoded

4 Tax Tips For Small Business Owners Tips Taxes Business Small Business Tax Small Business

Pin On Projects To Try

Depreciation Macrs Youtube

Depreciation Methods 4 Types Of Depreciation You Must Know