Employee 401k match calculator

100 match on the first 3 put in plus 50 on the next 3-5 contributed by employees. A 401k match is an employers percentage match of a participating employees contribution to their 401k plan usually up to a certain limit denoted as a percentage of the employees salary.

Is Your Company S 5mm 401k Plan Paying More Than 1 25 All In Do You Even Know What You Re Paying We Can Help Https 401kspec 401k Plan How To Plan 401k

Free 401K calculator to plan and estimate a 401K balance and payout amount in retirement or help with early withdrawals or maximizing employer match.

. This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck. Pay period frequency Current annual income Age at end of year 1 to 120 Employer match 0 to 300 Up to 0 to 20 Employer match 0 to 300 On next 0 to 20 Calculate. For example if your employer matches up to 3 percent of your gross income.

401k Retirement Calculator Calculate your retirement earnings and more A 401 k can be one of your best tools for creating a secure retirement. A percentage of the employees own contribution and a. Apply your companys match percentage to your gross income for the contribution pay period.

The most common formulas for 401 matching contributions are. The JPMorgan Chase 401k Savings Plan match calculator is a tool for match-eligible employees. Employer match The percentage of your annual 401 k contributions your employer will match.

Calculate your earnings and more. There are numerous match types businesses may offer. If you question How much do I need put in my 401k to retire begin by taking your companies full match.

Youre eligible for match if you have completed one year of service and have Total. The calculator assumes that your salary will continue to increase at this rate until you retire. The employer match helps you accelerate your retirement contributions.

401k Calculator Project how much your 401 k will give you in retirement. Employer 401 match programs usually incorporate two figures when calculating a total possible match contribution. If they each took.

Ideally you want to spread out your contributions across the year while maxing out your employer matching to avoid True Up risks read more about this here This 401K calculator does all the. See the impact of employer contributions different rates of return and time horizon. For every dollar you contribute to your qualified retirement plan your employer will also make a contribution to your.

It provides you with two important advantages. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. 140000 25 140000 25 30 45500 Now here an individuals contribution cannot exceed 19000 and hence the maximum amount that can be invested including both.

How to Calculate 401k Match in Excel. First all contributions and earnings to your 401k are tax-deferred. A 401k can be one of your best tools for creating a secure retirement.

As of January 2006 there is a new type of 401 k -- the Roth 401 k. A percentage of the employees own contribution and a. It provides you with two important advantages.

Ad Let Us Help Plan Your Financial Future with Courage Strength Wisdom. Employer 401k match types. Employer 401 match programs usually incorporate two figures when calculating a total possible match contribution.

Achieve Financial Well-Being with Equitable Financial Life Insurance Company NY NY. Say you have three employees making 50000 each. Then use our retirement calculator to determine if you will have enough for.

There can be no match without an employee contribution and not all 401ks offer employer matching. Monthly 401k Balance at. If you earn 60000 your contributions equal to 6 of your salary.

An online 401 calculator is a simple solution but you can figure the amount yourself easily enough. Assume that your employer matches 50 of your contributions equal to up to 6 of your annual salary. Of all Human Interest plans here are the most common formulas.

A 401 k can be an effective retirement tool. As an example an employ See more.

401k Calculator For Excel 401k Calculator Savings Calculator Spreadsheet Template

Traxpayroll Solutions Traxpayroll Solutions Payroll Software Filing Taxes

401k Contribution Limits And Rules 401k Investing Money How To Plan

Here S An Example Of How After Tax Contributions Work An Employee Over Age 50 Can Save Up To 62 000 In A Workpl Contribution Retirement Benefits Savings Plan

Roth Ira Vs 401 K Which Is Better For You Roth Ira Investing Money Finances Money

Retirement Savings Spreadsheet Spreadsheet Savings Calculator Saving For Retirement

What To Do With An Old 401 K Fidelity Investments Investing Fidelity Money Management

Five Reasons To Consider A Roth Conversion Roth Conversation Traditional Ira

Simple Ira Retirement Plan For Small Business Owners Simple Ira Retirement Planning Ira Retirement

Fire Calculators App Our Debt Free Lives Retirement Calculator Budget Calculator 401k Retirement Calculator

What Is A Retirement Plan Retirement Planning How To Plan Investment Advice

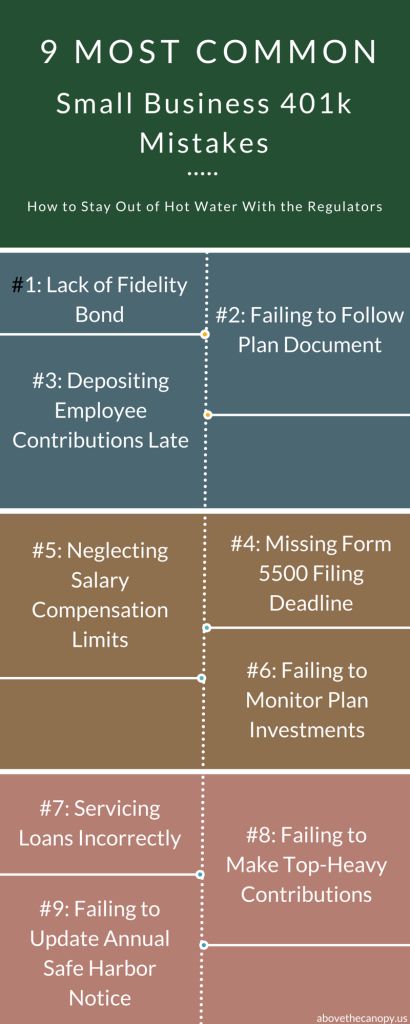

The 9 Most Common Small Business 401k Mistakes Above The Canopy Small Business 401k Small Business Resources 401k

Investment Goals Investing Investing For Retirement Retirement Savings Plan

Roth Ira Vs Traditional Ira Roth Ira Investing Traditional Ira Personal Finance Quotes

The 9 Most Common Small Business 401k Mistakes Above The Canopy Small Business 401k Small Business Resources 401k

Five Reasons To Consider A Roth Conversion Roth Conversation Traditional Ira

The 9 Most Common Small Business 401k Mistakes Above The Canopy Small Business 401k Small Business Resources 401k