Roth 401k conversion tax calculator

The good news is some plans allow you to get around that by converting your after-tax funds to Roth funds using an in-plan conversion or a rollover to a Roth IRA. 401k Save the Max Calculator.

Net Worth Scenario Tool Positive Numbers Negative Numbers Net Worth

Access to your money.

. Is a Roth. A conversion can get you into a Roth IRAeven if your income is too high. Just enter the length of whatever you need to measure choose the measurement you are currently using pick how specific you need your calculations to be and the calculator will do.

Roth IRA Distribution Details. Save on taxes and build for a bigger retirment. If you can pay it this once-and-done tax bill should not deter you from doing the Roth conversion because your Roth IRA funds will be growing tax-free for the rest of your life.

When it comes to a Roth Individual Retirement Account Roth IRA the answer could be yes. Converting to a Roth IRA may ultimately help you save money on income taxes. Contributions for a given tax year can be made to a Roth IRA up until taxes are filed in April of the next year.

Annual contributions are taxed upfront and all earnings are federal tax-free when they are distributed according to IRS rulesThis is much different than a Traditional IRA which taxes withdrawalsContributions can be withdrawn any time you wish and there are no required. Once you have 250000 or more in total plan value add up all your assets and cash in the plan you will file form 5500-EZ. Stock Market News - Financial News - MarketWatch.

Roth 401k contributions are made after taxes have been taken out of your paycheck. First place your contribution in a traditional IRAwhich has no income limits. Your eligibility to open a Roth IRA and how much you can contribute is determined by your Modified Adjusted Gross Income MAGI.

Traditional IRA vs Roth IRA. Please verify with your plan administrator that your distribution is eligible for a rolloverconversion. Any potential earnings grow tax-free and may not be taxed when you withdraw money in retirement.

Find out how much you can contribute to your Solo 401k with our free contribution calculator. Then move the money into a Roth IRA using a Roth conversion. For instance if you expect your income level to be lower in a particular year but increase again in later years you can initiate a Roth conversion to capitalize on the lower income tax year and then let that money grow tax-free in your Roth IRA account.

Use our 401k Early Withdrawal Costs Calculator first. Concerning Roth IRAs five years or older tax-free and penalty-free withdrawal on earnings can occur after the age of 59 ½. Grow Crypto Gains Tax Free with Roth 401k.

Learn about Roth IRA conversion. The conversion would be part of a 2-step process often referred to as a backdoor strategy. The Solo 401k is a retirement account and is tax-deferred therefore there is no tax return due for a Solo 401k plan.

Direct contributions can be withdrawn tax-free and penalty-free anytime. A Roth IRA is funded with after-tax dollars and qualified withdrawals are entirely tax-free. Like a traditional 401k the Roth 401k is a type of retirement savings plan employers offer their employeeswith one big difference.

A Roth IRA is an individual retirement account that offers the opportunity for tax-free income in retirement. FAQ Bitcoin In the Solo 401k. If you are a single or joint filer your maximum contribution starts to reduce at 125000 and 198000 for tax year 2021 and 129000 and 204000 for tax year 2022 respectively.

Once you do the Roth conversion the tax will be owed even if your financial circumstances change. Its fast simple and just as exact as you need it to be. You may gain tax benefits by converting funds from employer-sponsored retirement plans such as a 401k into a Roth IRA.

Solo 401k Retirement Calculator. That way the money you put into your Roth 401k grows tax-free and youll receive tax-free withdrawals when you retire. If you have less than 250000 in your 401k plan nothing needs to be filed.

As long as you have earned income up to the limit set by the IRS you can contribute to a Roth IRA. Roth conversions are permanent. 1 Additionally Roth IRAs arent subject to required minimum distributions RMDs which gives you greater control over your taxable income in retirement.

Ultimately both Roth and after-tax 401k plans can be valuable. They cannot be undone. You can withdraw your contributions at any time for any reason without taxes or penalties.

If you need to convert inches to feet centimeters to miles or meters to picometers our completely free length conversion calculator can help.

Ira Comparison Roth Vs Traditional Ira Fidelity Roth Vs Traditional Ira Traditional Ira Ira

Understanding The Mega Backdoor Roth Ira Roth Ira Roth Ira Conversion Ira

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

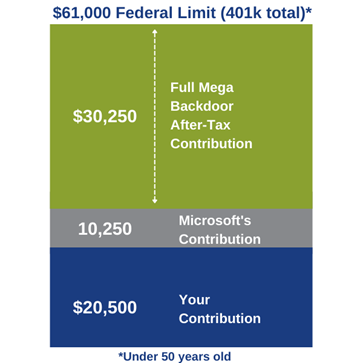

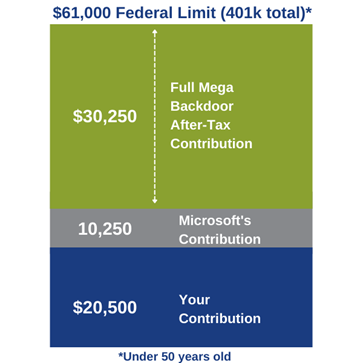

Microsoft S Mega Backdoor Roth Conversion Explained Our Blog Avier

Traditional Vs Roth Ira Calculator

Roth Ira Conversion Calculator Converting An Ira Schwab Roth Ira Conversion Roth Ira Conversion Calculator

3 Retirement Times Retirement Calculator Retirement Money Retirement Savings Calculator

The Ultimate Roth Ira Conversion Guide For 2022 Rules Taxes

Roth Conversions And Contributions 10 Principles To Understand White Coat Investor

Traditional Vs Roth Ira Calculator

A Betr Calculation For The Roth Conversion Equation Vanguard

What Can You Do With Your Title I Funds Retirement Checklist Life Transitions

Iul Vs Roth Ira Iul Vs Roth Ira For Dummies Youtube Universal Life Insurance Roth Ira Financial Literacy

A Roth Ira Conversion Is Probably A Waste Of Time And Money For Most

Pennies And The Backdoor Roth Ira The White Coat Investor Investing Personal Finance For Doctors Roth Ira Ira White Coat Investor

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal